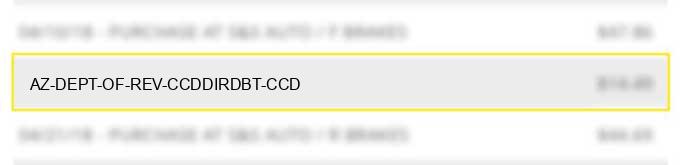

What is AZ DEPT OF REV CCDDIR.DBT CCD

The charge on your statement from the Arizona Department of Revenue may be for the Child and Dependent Care Credit. This credit is available to taxpayers who paid for child or dependent care so that they could work or attend school. To qualify, the care must have been provided for a child under age 13 or for a disabled spouse or dependent. The credit is worth a percentage of the amount paid for care, up to a maximum credit of $1,050 for one qualifying individual or $2,100 for two or more qualifying individuals. If you believe this charge is in error, you can contact the Arizona Department of Revenue at (602) 255-3381. Thank you for your question.

Comments for AZ DEPT OF REV CCDDIR.DBT CCD

Tell Us About This Charge

Your E-Mail address will NOT be published or shared.